Find out if Nationwide mortgages for over 55s are ideal for you in 2025

- Free home valuation

- 70% loan to value

- No lender, broker or advisor fees

- 4.89% fixed for life

- Ideal to pay off an existing mortgage

- No upper age limit

- No fixed term or end date

- Perfect for gifting or tax planning

- Penalty-free payment holidays

- Fee-free future further advances are subject to valuation

For example, if your home is worth £150,000, you can borrow £105,000.

Navigating the world of mortgages can be daunting, particularly for those aged 55 and over who may feel that their options are limited. Enter Nationwide, one of UK’s largest building societies, offering tailored mortgage products specifically designed to cater to the unique needs of this age group.

From lifetime mortgages to retirement interest-only loans, Nationwide provides a range of flexible solutions that allow retirees and pensioners to unlock home equity without sacrificing financial stability or peace of mind.

Key Takeaways

Key Takeaways:

- Nationwide Mortgages for Over 55s offer tailored financial solutions to allow homeowners to release equity from their properties without selling up.

- Nationwide offers two types of mortgages for over 55s: lifetime mortgages and retirement interest-only mortgages.

- Eligibility criteria include age 55 or over, owning a property in the UK, and demonstrating an adequate credit history.

- Important considerations when choosing one of these mortgage products include potential impacts on inheritance, interest rates and fees, and state benefits.

Understanding Nationwide Mortgages For Over 55s

Nationwide Mortgages for Over 55s are designed to help older homeowners release equity from their homes without having to sell up, and they differ from traditional mortgages in several ways.

Definition And Explanation

Nationwide Mortgages for Over 55s are tailored financial solutions designed specifically to cater to the mortgage needs of UK retired homeowners who have crossed the age of 55.

These mortgages offer a range of flexible options, allowing older borrowers to either release equity from their existing property or secure a new mortgage on more suitable terms that fit their current financial situation and requirements.

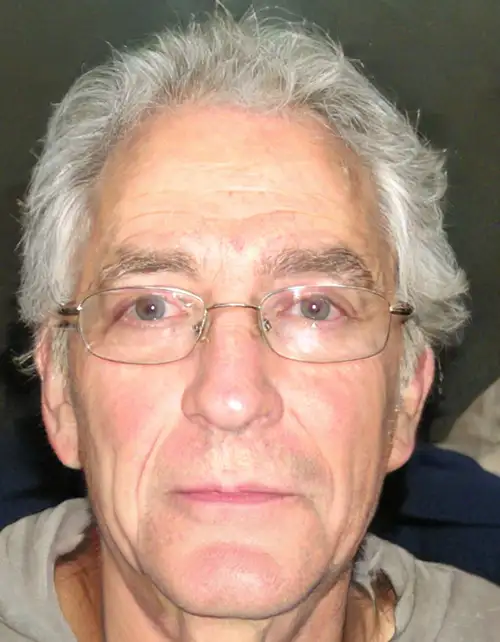

For example, Mr. Smith, a 65-year-old retiree with substantial home equity but limited pension income, wishes to downsize his house without needing significant monthly repayments.

With Nationwide’s specific over-55s product offerings like Retirement Interest-Only mortgages (RIO), he can secure the funding needed for this transition without putting undue pressure on his retirement budget.

This accessible solution provided by Nationwide makes it possible for customers like Mr.

Comparison To Traditional Mortgages

Nationwide mortgages for over 55s are designed specifically to cater to the unique needs of retired homeowners in the UK, offering more flexibility and tailored options compared to traditional mortgages. Here is a table comparing the two:

| Features | Traditional Mortgages | Nationwide Mortgages for Over 55s |

|---|---|---|

| Age limit | Generally, 75 years | Minimum 55 years, with no upper age limit |

| Repayment options | Capital and interest or interest-only | Retirement interest-only or lifetime mortgages |

| Interest rates | Variable, may change over time | Range from 2.37% MER to 3.85% APR variable |

| Eligibility criteria | Income, credit score, employment status | Age, property value, location, financial assessment |

| Impact on state benefits | Potentially limited or unaffected | Needs to be considered, as it can impact certain benefits |

| Property eligibility | Main residence and/or investment properties | Primary residence and/or investment properties |

| Equity release | Not applicable to traditional mortgages | Available through lifetime mortgages for over 55s |

This comparison highlights the key differences between traditional mortgages and those Nationwide offers for retired homeowners over 55 years old. It is essential to weigh these differences before deciding on the most suitable mortgage option for your specific needs and circumstances.

Eligibility Criteria

To qualify for Nationwide Mortgages for Over 55s, applicants must meet specific eligibility requirements set by the lender. Primarily, individuals should be older than 55 and own a property in the UK.

In some cases, pensioner mortgages or retirement interest-only mortgages (RIO) may demand additional criteria such as minimum income levels or sufficient equity in your property.

For instance, when applying for a RIO mortgage, you must prove that you have sustainable retirement earnings to cover the ongoing interest payments.

Types Of Nationwide Mortgages For Over 55s

Nationwide offers two types of mortgages for over 55s: lifetime mortgages and retirement interest-only mortgages.

Lifetime Mortgages

Nationwide offers lifetime mortgages, which are specifically designed for retired homeowners over the age of 55. These mortgages allow you to release equity from your property without selling it or moving out.

The interest on the loan is added to the amount borrowed and compounded annually until the mortgage is repaid either when you die or sell your home. This means that no monthly repayments are required, although options are available if you wish to make payments towards the interest charges.

With Nationwide’s lifetime mortgages, borrowers can typically release up to 56% of their property value.

Retirement Interest-only Mortgages

Nationwide offers retirement interest-only mortgages with fixed and tracker rates for existing members. These mortgages are a new way for older borrowers and people over 60 to get a mortgage on their homes.

These loans allow you to pay only the interest, keeping your monthly payments low and manageable while still maintaining ownership of your property. As these types of mortgages require no repayment until the end of the term or sale of the property, they allow homeowners to enjoy their retirement while releasing equity in their homes.

Advantages Of Choosing Nationwide Mortgages For Over 55s

Choosing a Nationwide mortgage for over 55s offers numerous benefits, including the opportunity to release equity in your property, flexible repayment options and no monthly repayments required.

Release Equity In Your Property with a Nationwide over 55 mortgage.

One of the key advantages of choosing Nationwide Mortgages for Over 55s is the ability to release equity in your property. This means that you can access some of the value of your home without having to sell it.

Perhaps you want to gift money to family members or tackle outstanding debts or expenses. With a Nationwide lifetime mortgage, retirement interest-only (RIO) mortgage, or retirement capital and interest (RCI) mortgage, you’ll have flexible repayment options and no regular monthly repayments required.

Instead, the amount borrowed plus any accrued interest will be repaid when the property is sold, typically after you pass away or move into long-term care.

No Monthly Repayments Required

One of the most significant benefits of choosing a Nationwide mortgage for over 55s is that there are no monthly repayments required. This means retired homeowners can unlock the equity in their homes without worrying about keeping up with regular payments.

Instead, the loan plus interest is repaid when the property is sold, or upon death or moving into long-term care. This offers financial flexibility in retirement and allows borrowers to obtain a lump sum payment or receive smaller amounts over time as needed.

Flexible Repayment Options with a Nationwide Retirement Interest Only Mortgage

One of the advantages of choosing a Nationwide Mortgage for over 55s is the flexible repayment options available. With this type of mortgage, you’ll be free to either make no regular monthly repayments or only pay interest.

Additionally, Nationwide offers a Retirement Interest Only Mortgage that requires you to only pay the interest each month and is secured against the value of your home. This option allows you to release some equity from your property while ensuring that it remains yours until it’s time to sell or pass it on as an inheritance.

Risks And Considerations for an Interest only mortgage over 55

It’s important to consider the impact of a Nationwide mortgage on your inheritance and the interest rates and fees involved. Additionally, those receiving state benefits should be aware of potential impacts.

Impact On Inheritance

It’s important to consider the potential impact that a Nationwide mortgage for over 55s could have on your inheritance. With a lifetime mortgage, the equity release from your property will accumulate interest over time and may result in less money being passed down to your heirs.

Before deciding on any type of mortgage product, it’s essential to weigh up the pros and cons carefully and seek advice from independent professionals such as financial advisors and solicitors.

It’s also worth noting that Nationwide has specific eligibility criteria for its mortgages, including age limits and financial assessments.

Interest Rates And Fees For Over 55 Mortgages UK

Interest rates and fees are important considerations when choosing a Nationwide mortgage for those over 55. The interest rate on lifetime mortgages is usually higher than traditional mortgages, reflecting the fact that repayments are deferred until the property is sold, or at death.

Fees typically include legal costs, valuation fees and arrangement fees, which vary from lender to lender.

Another significant cost factor is early repayment charges (ERCs), which may apply if you decide to clear your mortgage or sell your home earlier than anticipated.

It’s crucial to always read through all paperwork thoroughly before signing up for a particular product. Make sure that you understand precisely what you’re agreeing upon, and seek independent advice if needed.

Impact On State Benefits

Considering the impact of taking out a Nationwide Mortgage for Over 55s on your state benefits is essential. Depending on your circumstances, such as the amount of equity you release or how much income you receive from the mortgage, it could potentially affect your eligibility for certain benefits.

For example, if releasing equity from your home pushes you above the threshold for means-tested benefits like Pension Credit or Council Tax Reduction, then applying for a Nationwide Mortgage may not be in your best interest.

However, some types of retirement mortgages may offer more flexibility than others regarding how they affect state benefits.

Eligibility Requirements for Nationwide Lifetime Mortgages

Certain age limits, property value and location criteria, and financial assessments must be met to qualify for Nationwide Mortgages for Over 55s.

Age Limit And Other Criteria

To be eligible for a Nationwide mortgage for those over 55, you must meet some age criteria. Generally, the minimum age is usually 55 years old, but some lenders have increased their maximum ages to up to 85 years old.

For instance, if you’re considering a lifetime mortgage from Nationwide, your eligibility will depend on factors such as your property’s worth and your age when taking out the loan.

Similarly, if you’re applying for a retirement interest-only mortgage (RIO), you’ll need to prove that you can afford the monthly interest payments before being approved.

Property Value And Location for Lifetime Mortgage Nationwide Building Society

The value of your property and where it is located can impact your eligibility for a Nationwide mortgage as an over-55. The lender considers various factors, such as whether the property is a semi-detached freehold house or a leasehold flat and whether the resident is an assured shorthold tenancy tenant.

Properties in urban areas with high demand will usually have higher values than those in rural locations. Additionally, Nationwide may refuse to offer mortgages to anyone who does not meet its criteria based on location and property value; however, alternative options could still be available.

Financial Assessment for the best nationwide rio mortgage rates

Before approving a Nationwide mortgage for over 55s, the lender will conduct a financial assessment to ensure applicants can afford the repayments. This involves looking at income sources, expenses and other factors affecting their ability to make payments.

It’s worth noting that the financial assessment considers age-related factors such as pension income and retirement plans. Therefore, even if you are retired, securing a Nationwide Mortgage for Over 55s is still possible as long as you meet the eligibility criteria outlined by the lender.

How To Apply For A Nationwide Mortgage For Over 55s

To apply for a Nationwide Mortgage for Over 55s, interested applicants can visit the Nationwide website and fill out an application form. Required documents include proof of income, identification, and details about the mortgaged property.

Application Process for a nationwide over 55 mortgage

Applying for a Nationwide mortgage for over 55s is a straightforward process. First, you must check your eligibility criteria, including acceptable deposit amounts and credit scores.

Once you’ve determined that you meet the requirements, you can begin the application process by filling out an online application form or speaking with a Nationwide representative.

You must also provide documentation such as proof of income and identification.

The timeframe for approval may vary depending on individual circumstances, but it typically takes two weeks to one month. Legal procedures may be required before you receive the funds in your account if approved.

Required Documentation for a nationwide retirement interest only mortgage

You must provide documentation to apply for a Nationwide mortgage for over 55s. This includes proof of your identity, such as a passport or driving license, and evidence of your earnings and deposit.

For example, if you are applying for a retirement interest-only mortgage, you must prove you can afford the monthly interest payments. This could include pension statements or details of any other income streams.

It’s important to ensure that all documents provided are accurate and up-to-date to avoid delays in the approval process.

Timeframe For Approval for a Nationwide retirement mortgage

Once you have completed your application for a Nationwide mortgage for over 55s, receiving an offer typically takes around two weeks. However, if your application is more complex, such as applying for a more significant sum or there are issues with the property valuation, it could take longer.

It’s important to note that having all the necessary documentation and providing accurate information can help speed up the approval process when applying for any mortgage product.

It’s best to plan and give yourself plenty of time before needing the funds from your mortgage.

Legal Procedures Required

Legal procedures are required to apply for a Nationwide mortgage for over 55s. This includes having the property surveyed and valued by a qualified surveyor and hiring a solicitor or conveyancer to handle the legal aspects of the transaction.

It’s essential to choose an experienced professional who understands the unique needs of older homeowners and can provide tailored advice throughout the process. Additionally, applicants should know that taking out a mortgage may impact their inheritance plans and seek independent financial advice before making any decisions.

Tips For Choosing The Right Mortgage

When choosing a Nationwide mortgage product for over 55s, seeking independent legal and financial advice is crucial, comparing rates and terms from different lenders, and assessing your individual needs and preferences is crucial.

Seeking Independent Legal And Financial Advice

Anyone considering a Nationwide Mortgage for Over 55s is highly recommended to seek independent legal and financial advice before making any decisions. These types of mortgages can have complex terms and conditions and long-term implications on your finances and estate planning.

For example, an advisor may be able to provide guidance on how much equity you should release from your property, what repayment options would suit you best, or whether a different type of mortgage product could better meet your needs.

They may also be able to advise on the potential impact the mortgage could have on inheritance tax liabilities or state benefits eligibility.

Nationwide Retirement Interest Only Mortgage

Nationwide offers retirement interest only mortgages, designed to support financial stability for retirees. For homeowners seeking to consolidate debts, options such as Nationwide BS Homeowner Loan can be explored.

Nationwide Lifetime Mortgage Rates

Nationwide provides competitive lifetime mortgage rates, enabling retirees to access equity in their homes. Calculating these costs is made simpler with tools like the TSB loan calculator uk.

Home Improvement Financing

Home improvements can be financed through products like Nationwide home improvement loan, which may add value to your property.

Debt Consolidation Options

Debt consolidation can offer a way to manage multiple debts more efficiently. Products such as Royal Bank of Scotland Debt Consolidation With Mortgage may assist in this regard.

Loans for Those with Bad Credit

For individuals with a less-than-perfect credit score, services like Homeowner Loans For Bad Credit can provide necessary financial support.

Secured Loan Services

Securing a loan against property is possible through services like Natwest secured loan, which may offer the needed funds for various purposes.

Loan Calculators

Understanding potential repayments is crucial, and calculators such as the HSBC secured loan calculator can be quite helpful in this planning stage.

Specialist Loan Brokers

Working with specialist brokers who offer loans for bad credit no brokers might help you find a suitable loan without the need for an intermediary.

Direct Lending Options

Direct lending options, such as Direct Lender Secured Loans, can offer a straightforward path to securing a loan, often with less stringent credit requirements.

Comprehensive Debt Solutions

For a holistic approach to debt management, considering options like Barclays Remortgage For Debt Consolidation can provide a more manageable repayment structure.

Comparing Rates And Terms – Nationwide lifetime mortgage rates

It’s essential to compare rates and terms when choosing a mortgage product. With Nationwide Mortgages for Over 55s, you can use their online mortgage rate finder to see available interest rates across the range of mortgages they offer.

When comparing rates, it’s also important to consider any fees or charges associated with the mortgage. For example, Nationwide offers a range of tools and resources for managing an existing mortgage, such as checking account details, making overpayments, and exploring Early Repayment Charges.

By understanding all aspects of a mortgage product, you can make an informed decision that works best for your financial situation.

Assessing Individual Needs And Preferences when considering Nationwide RIO mortgage rates

When considering a Nationwide mortgage for over 55s, assessing your individual needs and preferences is essential. This involves identifying what you want from the mortgage product, such as flexible repayment options or no monthly repayments required.

It’s also important to seek independent legal and financial advice when choosing the right mortgage product. Comparing rates and terms between different mortgages can help you find one that best suits your needs.

Finally, ensure that you meet the eligibility requirements by providing bank statements for affordability assessments and proving that you meet age limits, acceptable deposit proofs, foreign nationals’ allowances, credit scoring criteria.

Comparison With Other Mortgage Products For Over 55s

Compare the rates and terms of Lloyds, Halifax, and NatWest mortgages for over 55s with those offered by Nationwide to determine which product is right for you.

Lloyds interest only mortgages for over 55s

Lloyds is one of the banks offering equity release schemes for over 55s. Their loan-to-value percentages can be compared with other mortgage products, providing flexibility and options for retired homeowners.

Fixed-rate equity release for homeowners over 70 at 3.77% AER is also offered by Halifax, while Post Office offers later life mortgages and Barclays Bank provides interest-only mortgages specifically designed for people over 65 years old.

Halifax

Halifax offers lifetime mortgages for over 55s, with a fixed rate of 4.16% until 2025 for those over 70. This mortgage product allows retired homeowners to release some of the equity tied up in their property while still retaining ownership and living in their home.

It’s important to note that other options are also available, including retirement interest-only mortgages and equity release products offered by other providers like Nationwide Building Society.

NatWest

NatWest is a mortgage provider that has increased its age limit to 75, which means more people can now apply for mortgages as the retirement age rises. Additionally, for those over 60, NatWest offers a fixed-rate Lifetime Mortgage with an interest rate of 3.56%.

It’s worth considering this option if you want to release equity from your home and secure flexible repayment options without making monthly repayments.

Reviews Of Nationwide Mortgages For Over 55s

See what other retired homeowners have to say about their experience with Nationwide Mortgages for Over 55s, including feedback on customer service, interest rates and fees, and the application process.

Customer Feedback And Satisfaction for a Nationwide RIO Mortgage

Nationwide Mortgages for Over 55s have received mixed reviews from customers. Some clients complain about poor customer service, while others are satisfied with their experience.

The mortgage lender has an average rating on Trustpilot based on over 5000+ customer reviews, with some praising the quick and efficient process of securing a mortgage.

Overall, it’s essential to consider Nationwide’s customer feedback and its products’ features before deciding whether to apply for a mortgage as an over-55 homeowner.

Potential Drawbacks Or Limitations of a lifetime mortgage Nationwide

It’s important to consider the potential drawbacks or limitations of taking out a Nationwide Mortgage for Over 55s. One common concern is the impact on inheritance, as interest and fees accumulate and must be paid off when the property is sold.

Additionally, interest rates and fees can be higher than those of traditional mortgages, which could result in higher payments over time.

Despite these considerations, many retirees find that Nationwide Mortgages for Over 55s offer significant advantages in terms of releasing equity in their properties without needing to make monthly repayments.

A Look at Nationwide Equity Release Schemes

Equity release offers homeowners over 55 a way to release capital tied up in their homes. One such offering is the Standard Life drawdown retirement mortgage, an excellent choice for those looking to supplement their income during retirement.

Understanding Yorkshire Bank RIO Mortgage

The Yorkshire Bank RIO mortgage is a retirement interest-only mortgage that allows you only to pay the interest on your mortgage, making it an affordable option for retirees.

Insights into Lifetime Mortgages Nationwide

Lifetime mortgages are a popular type of equity release product. With these mortgages, homeowners over 55 can borrow money against the value of their home. A notable example is the Nationwide lifetime mortgages over 65, which offer flexible terms and conditions.

TSB RIO Mortgages: A Comprehensive Look and comparison with Nationwide lifetime mortgage interest rates

TSB RIO mortgages provide a sensible solution for homeowners over 60 looking to manage their monthly payments effectively while retaining ownership of their property.

What Are Retirement Interest Only Mortgages Nationwide?

Retirement mortgages, like the Nationwide retirement mortgages over 60, provide a financial solution for retirees. These products allow homeowners over 60 to release equity from their homes while making interest-only payments.

Yorkshire Building Society Interest Only Retirement Mortgages: An In-Depth Analysis

Yorkshire Building Society interest only retirement mortgages provide an excellent solution for homeowners over 60. These mortgages allow you to only pay the interest on your mortgage, ensuring manageable monthly payments.

Overview of Nationwide Later Life Mortgages

Pensioner mortgages are increasingly popular among retirees looking to retain financial independence. The Nationwide retirement mortgage over 65 provides older homeowners a feasible way to supplement their retirement income.

Skipton Building Society Retirement Remortgage: A Closer Look

The Skipton Building Society retirement remortgage provides a fantastic option for homeowners over 65 seeking a way to manage their finances more efficiently during retirement.

Nationwide Interest Only Lifetime Mortgages Over 70

Nationwide’s interest only lifetime mortgages over 70 offer older homeowners the opportunity to leverage their property wealth without having to make any regular repayments.

Family Building Society Interest Only Lifetime Mortgages

The Family Building Society offers interest only lifetime mortgages, providing a viable alternative for retirees to better manage their monthly payments.

Exploring RBS Retirement Remortgages Over 60

RBS retirement remortgages over 60 offer a flexible and accessible solution for older homeowners to maintain a comfortable standard of living during their retirement.

Marsden Building Society Interest Only Lifetime Mortgage Over 70

The Marsden Building Society provides a compelling interest only lifetime mortgage over 70. This mortgage product allows older homeowners to enjoy their retirement without worrying about large monthly payments.

Equity Release Products for Individuals Over 75

Equity release products, like the Nationwide retirement mortgages over 75, offer homeowners over 75 a way to leverage their property wealth, enabling them to lead a financially secure retirement.

Financial institutions such as Nationwide, HSBC, Lloyds, Barclays, Halifax, Standard Life, TSB, and Leeds all offer various financial products that cater to the unique needs of different age groups. This ensures that homeowners can make the most of their property wealth during their retirement years.

Frequently Asked Questions for a Nationwide Retirement Mortgage

Here are some common questions about Nationwide Mortgages for over 55s.

Common Queries Addressed for Nationwide Retirement Mortgages

Many retired homeowners may have questions about Nationwide Mortgages for Over 55s, such as how to apply or the eligibility requirements. Some common queries include how much equity can be released from their property and whether they will still own their home after taking out a mortgage.

Nationwide provides support pages for managing mortgages online and has a guide for required documentation during the application process. Existing members can easily access their mortgage rates and make changes online, while those needing assistance can contact Nationwide directly for help.

Nationwide retirement interest only mortgage rates in 2025

Nationwide Mortgages for over 55s offer a flexible and affordable way for retired homeowners to access their equity. With various options available, such as lifetime or retirement interest-only mortgages, eligible applicants can benefit from no monthly repayments and flexible repayment options.

However, it is essential to consider the impact on your inheritance, interest rates and fees, and state benefits before applying. By seeking independent legal and financial advice and comparing rates and terms with other mortgage products for over 55s from Lloyds, Halifax or NatWest; you can ensure that you choose the best option that suits your needs.

FAQs:

1. What is a nationwide mortgage for over 55s?

A Nationwide mortgage for over 55s is a type of loan specifically designed to help people aged 55 and above access the equity in their homes while still being able to live in them. The loan can be used for various purposes, including making home repairs, paying off debts, or improving quality of life.

2. How does a nationwide mortgage for over 55s work?

The loan works by allowing homeowners aged 55 and above to release some of the equity in their property without having to move out. This means they can receive cash payments upfront or choose regular income payments based on the amount borrowed via an annuity scheme.

3. Can I qualify for a nationwide mortgage if I already have a mortgage on my property?

Yes, you may still qualify for this type of loan even if you have an existing mortgage on your property. However, any outstanding balance must be paid off before calculating the amount of equity available and how much could be released through this new financing option.

4. Are there any risks involved with getting a Nationwide Mortgage For Over 55s?

As with any financial product, certain risks are associated with taking out a Nationwide Mortgage For Over 55s – such as possible negative effects on inheritance or repayment difficulties due to changes in interest rates – so potential borrowers must consider all factors before applying. It is recommended that individuals seeking this type of financing speak with their financial adviser about both the advantages and possible drawbacks beforehand as well as assess whether other options would be more suitable given individual needs/circumstances when considering borrowing money against one’s home equity value at retirement age where current market conditions always change unpredictably over time thereby affecting future repayments (e.g., inflation).